Meet

Composer

Trading. Built better.

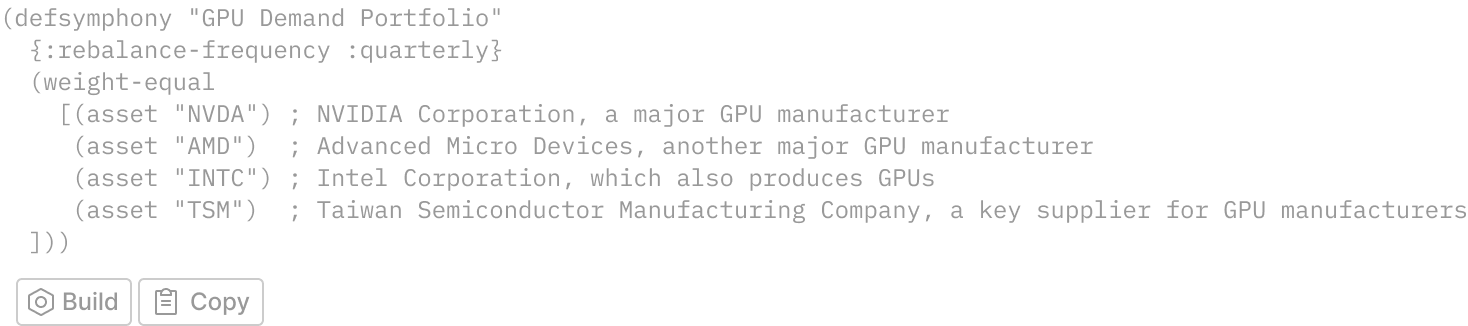

AI-powered

strategy creation

Explain your goals, strategy, and risk concerns in natural language — our AI-assisted editor will create the strategy for you.

More automation, less worry

Composer executes your trading strategy, making trades and rebalancing automatically.

Discover pre-built strategies

Find strategies you can invest in right away, across a variety of purpose-driven categories, like Long Term, Technology Focus, and Diversification.

A portfolio that reacts

to the market

Don’t get caught up in emotions and sensationalized tweets. Trade based on data and market movements.

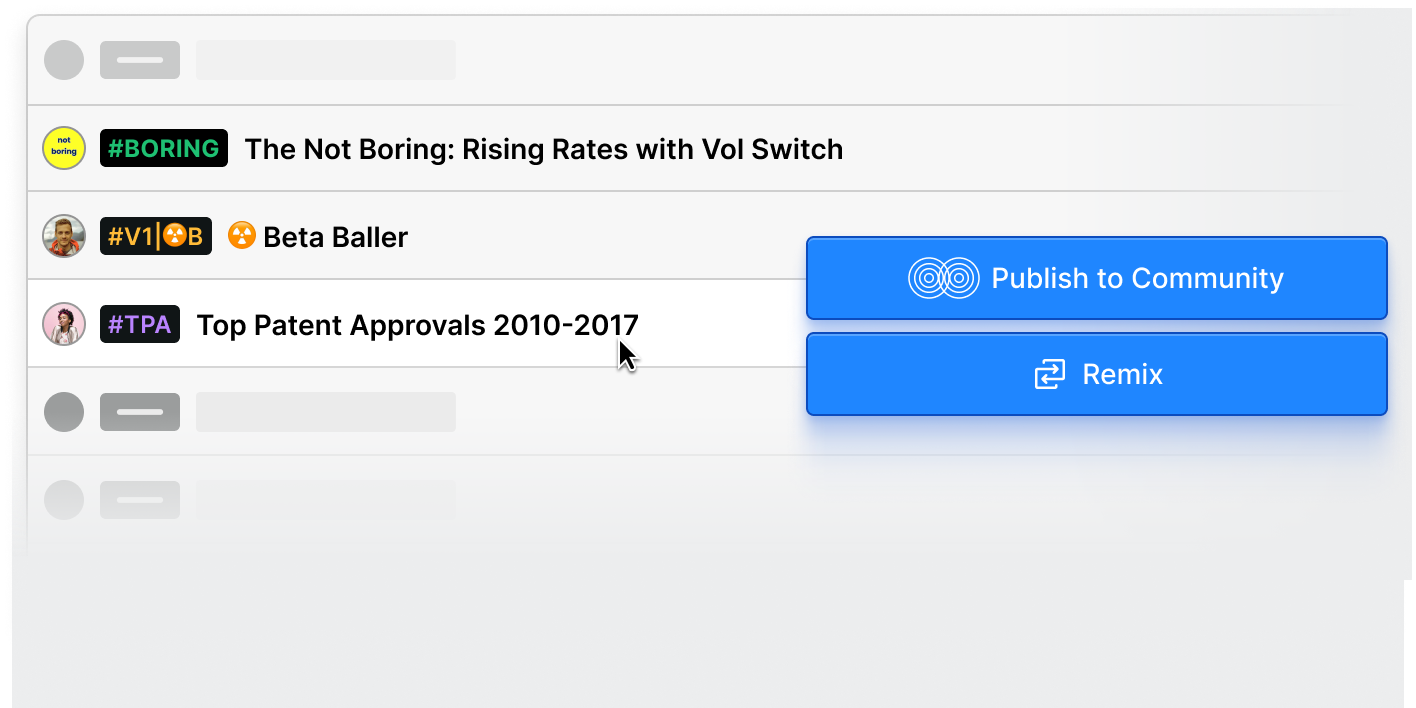

Community

See what others are creating with Composer. Invest directly or make changes. Submit your own strategies to the Community.

Composer is the brokerage

Fully automated trading execution, end-to-end. Create and fund your account in the app.

No commissions on trades

Zero commissions, zero management fees.

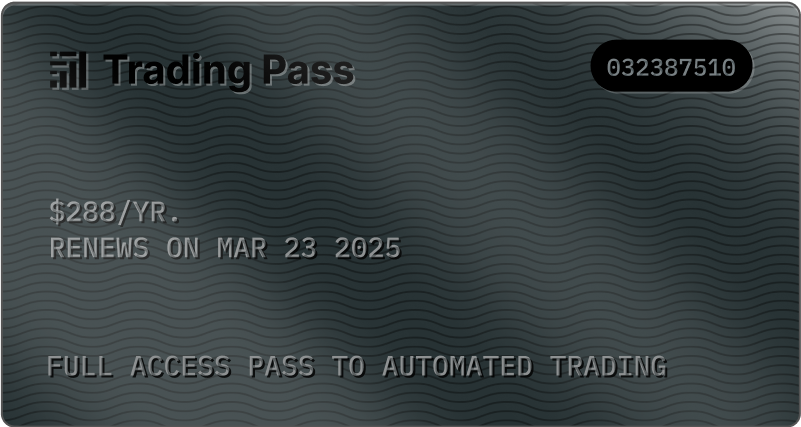

Transparent pricing

Simple fixed monthly subscription.

Test for free.

Tax-smart active trading in your retirement account

- Traditional IRA

- Roth IRA

- Earn a 1% bonus on transfers

- We'll cover your transfer fees

One Trading Pass, Unlimited Access

Your Composer Trading Pass unlocks unlimited automated trading

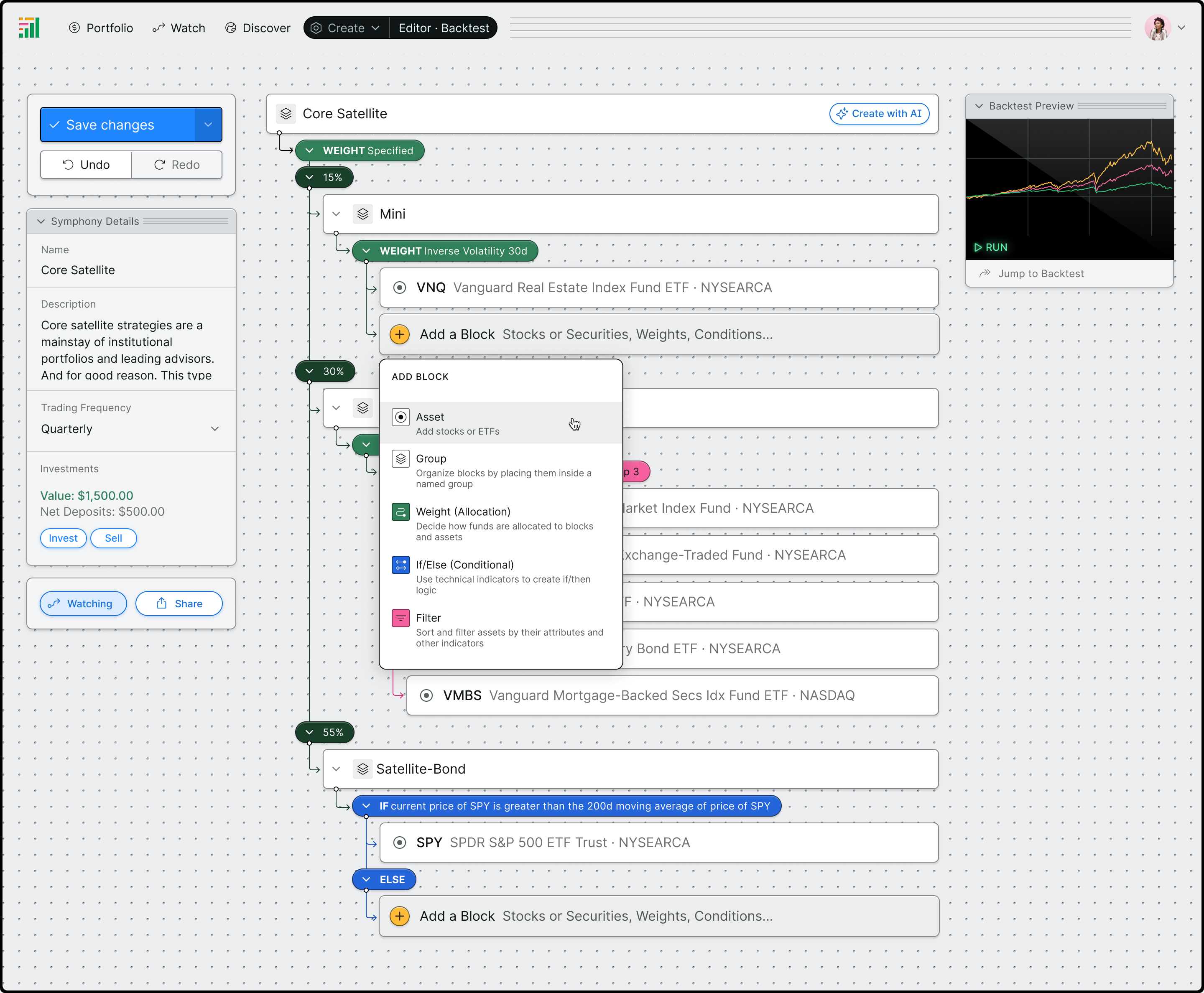

Customize and

Create

Every strategy on Composer is fully editable. Swap out assets, adjust programmatic logic, and tweak parameters.

Use our no-code, visual editor to modify symphonies or create your own from scratch.

Apply weighting

Custom weight, inverse volatility, market cap or balance equally.

If this, then that

Add conditionals to control the flow of logic.

Sort, filter, select

Start with a pool of candidates and dynamically select those that meet your criteria.

Learn and adapt

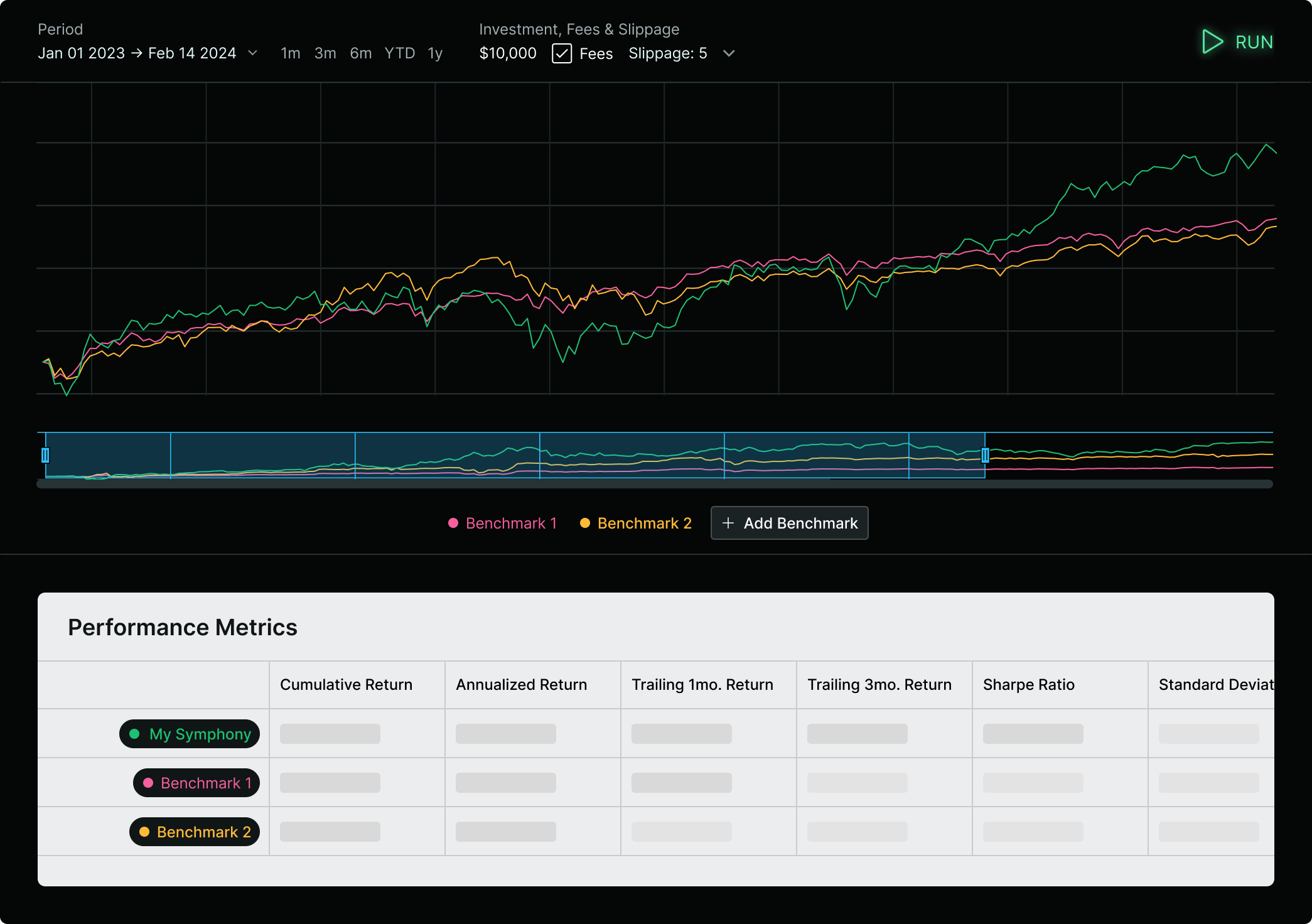

Backtest your strategy. Compare it to a benchmark or to another strategy.

Learn from what you see. Tinker and try it out again. And again.

The Historical Allocation Graph visualizes movements in a symphony’s holdings over time.

Model the value of your symphony

Fees, slippage and final value are calculated for you.

Share what you build

Share your strategy with others. They’ll be able to test it and even invest in it.

Composer is by far the best product I’ve come across in a long time.

It’s an absolute gamechanger.

Xuan X.L.

I've been doing this for 35 years and havenever seen a tool like this. Not even my Bloomberg!

Douglas T.

Composer gives traders and investors at all levels an easy and intuitive way to develop, trade and automate their investment strategies.

Composer opens up to anyone the same level (or better) of tools that top quantitative hedge funds hire armies of PhDs and computer scientists to build internally.

Wow, @ComposerTrade makes it ridiculously simple to create automated trading strategies

@meetnaren

Most automations require you to understand detailed spreadsheets and unique coding languages, the learning curve is often intense with these platforms. That’s not the case at all with Composer.

Frequently Asked

Questions

About Us

Founded in 2020, Composer's mission is to create investing software that feels fun, stimulating and creative.

We're proud to be leading a movement that makes sophisticated quant investing accessible to all.

Join us!

Our investors